v 31.38 | California’s Sugar High and Crash

Welcome to Happening in California, a brief look at political news, insights, and analysis of the world’s fifth-largest economy. If you're new to the Happening newsletter, welcome. I've been sending this periodic newsletter since 2021 and you can find the archive here.

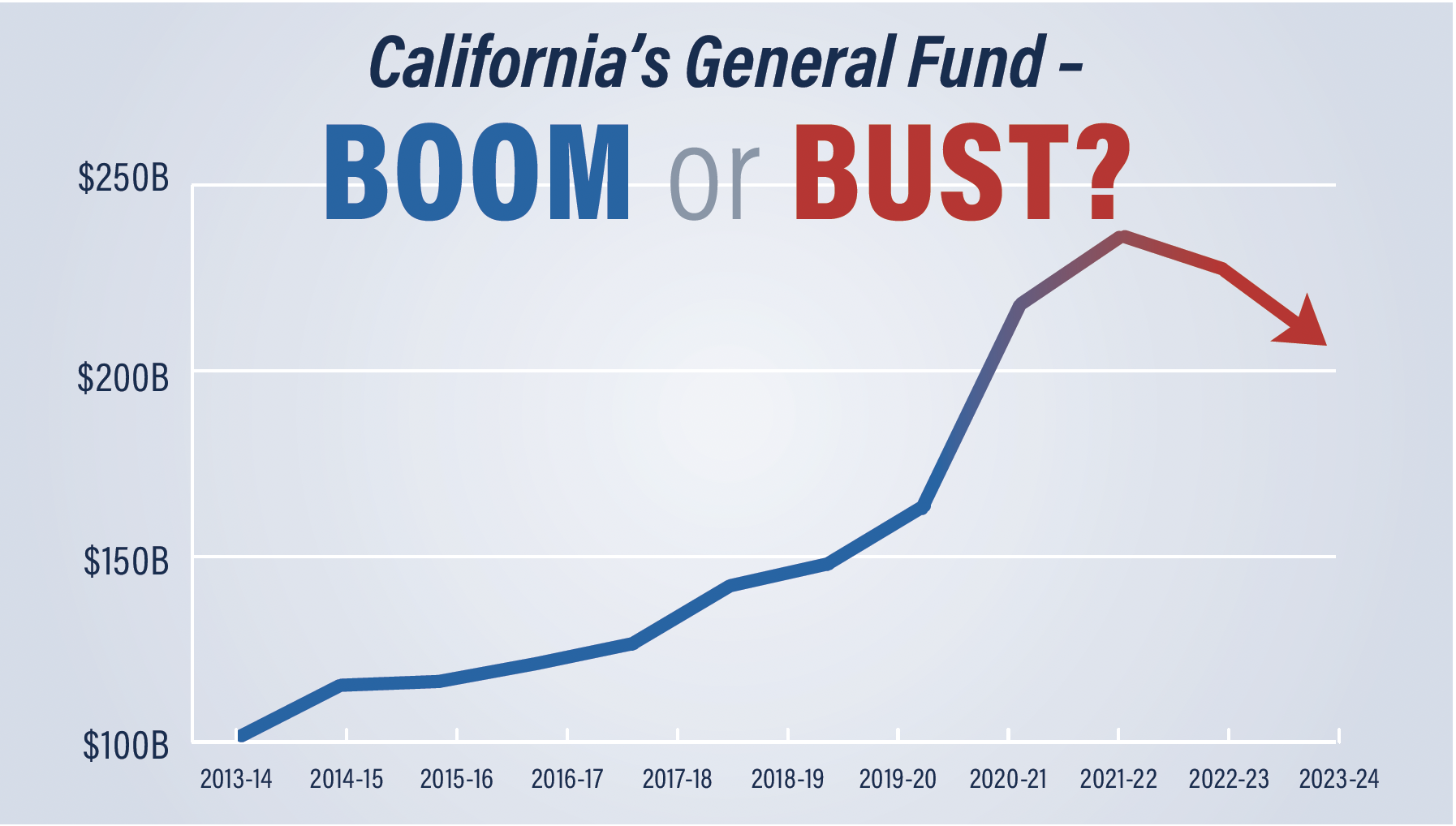

The sugar high has officially worn off. For the second straight year, Governor Newsom unveiled a budget that projects a large budget deficit.

For years, Sacramento lawmakers have grown spoiled from the fruits of Silicon Valley’s success which resulted in record high tax revenue. Now, as the economy slows, will California be able to maintain its lofty spending?

Here are some basic facts to know …

Cheers,

Tom Ross | President and CEO | Swing Strategies

P.S. Please feel free to forward this email along to friends and encourage them to sign up here.

The Big Picture: A month ago, California’s nonpartisan budget advisor projected a $68 billion deficit. A month later, the Governor estimated a $38 billion deficit and vowed not to declare a budget emergency until later this year. Ultimately, the real extent of California’s budget shortfall won’t be known until May ...

The state’s General Fund, which is the biggest source of revenue for the state budget, has grown by a whopping 134% in the last 10 years. Currently, most of the General Fund revenue comes from Personal Income Tax (PIT) revenue, specifically high-income earners in the Bay Area.

Since 2009, California's PIT revenue has tripled — contributing $125 billion to the state budget in 2021. Much of the growth in PIT revenue can be attributed to the high-income technology sector jobs and capital gains from Silicon Valley's unicorns and major Initial Public Offerings (IPOs), including those of Facebook, Uber, and Tesla.

For example, a Tesla employee with $10,000 in stock on the day of its IPO would have realized more than $1.5 million in capital gains if the stock were sold today according to an article in U.S. News — generating nearly $200,000 of PIT revenue for the state.

Absent a new AI-induced boom cycle in California, the state’s reliance on Silicon Valley to fill its coffers may be looking like a bust.

For more information on how California’s General Fund revenue is generated, revisit our Happenings from last August. In it, we forecasted the likelihood of the state’s current budget deficit.

While California’s $38 billion budget deficit is alarming, it would be far worse if not for the $20.9 billion in rainy day funds created by the state’s last budget heroes — former Governors Arnold Schwarzenegger and Jerry Brown. Against the Legislature’s nature to spend beyond the state’s means, Governor Schwarzenegger led the effort to pass the first rainy day fund in 2004 and kept working to strengthen it until he left office. Governor Brown picked up where Schwarzenegger left off — establishing the current rainy day fund with Prop. 2 in 2014.

Without the foresight of Governors Schwarzenegger and Brown, California most certainly would not be sitting on more than $20 billion in reserves to help cushion the state’s budget deficit. This is a lesson many local governments failed to learn …

A developing subplot to California’s budget crisis may be the growing number of large cities and counties who are also facing a squeeze on their budgets as a result of overspending and slowing revenue growth.

San Francisco: Facing projected shortfalls of $245 million in the upcoming fiscal year and $554 million in the following year, San Francisco is grappling with an $800 million deficit. Thus prompting Mayor London Breed to request departments to prepare for 10% budget cuts as a measure to address the financial gap.

San Diego: The City of San Diego is anticipating over $1 billion in deficits over the next five years. City officials attribute this to increased worker salaries, larger pension payments, and increased spending on homelessness.

Santa Clara County: Santa Clara is ranked as one of the wealthiest counties in California; despite this, the county is entering the next fiscal year with a $280 million deficit.

Oakland: Oakland recently worked to plug a $360 million structural budget deficit, but still faces more fiscal uncertainty.

For more on local government finances, check out our previous Happenings that examined “high risk” municipalities.

The Bottom Line: All good things come to an end. And so it is that California is now experiencing a 'sugar crash' after years of record revenue growth. As we head into an election year, the challenge for state and local leaders is to reduce spending without upsetting voters.

As always, give us a ring or shoot us an email if you’d like to chat about what’s happening in California.